Honda Of Bellingham for Dummies

Table of Contents4 Easy Facts About Honda Of Bellingham Explained3 Simple Techniques For Honda Of BellinghamAll about Honda Of BellinghamThe Honda Of Bellingham DiariesThings about Honda Of Bellingham

It's Even more Than Finding the Right Automobile. By going shopping around at dealerships and among personal vendors for the vehicle they love the most. On standard, over 60% of car buyers finance or lease their brand-new or pre-owned automobile, several auto customers assume concerning where to fund as an afterthought.They shop and get pre-approved for funding before shopping for a cars and truck. A car is the 2nd most pricey acquisition that many individuals make (after a house), so the payment and interest rate issue.

They have some points in common, yet comprehending their differences will aid you obtain right into the brand-new or used car that ideal matches your demands. It's appealing to finance your new vehicle right at the dealership.

Honda Of Bellingham Things To Know Before You Buy

In enhancement, if you get involved in warm water with your lending and miss a repayment or 2, you may find yourself handling a lender halfway throughout the nation who has no direct connection with you and is not inclined to be as suiting as various other regional banks. And of course, the dealer would like you maintain paying the lending to ensure that they remain to make money off the rate of interest you are paying, however if you can not, they repossess the automobile, redeem their losses, and go on, with little to no worry for the consumer.

These promos might consist of very reduced rate of interest prices maybe also 0% or appealing cashback offers. Keep in mind, however, that these deals are typically only offered on brand new cars and to clients with squeaky tidy debt.

Because they understand you and have a connection with you, they may be ready and able to offer you a lower rate of interest than a car dealership. The financial institution may even offer rewards to funding with them if you do all your financial under their roofing system. When funding a cars and truck through a bank, you have the advantage of looking around at different establishments to get a competitive bargain or terms that best align with your spending plan and credit scores profile.

Honda Of Bellingham Fundamentals Explained

An additional important pro to financing with a financial institution is that you will avoid shocks. Banks will look at your entire picture initially, and afterwards assembled a loan program that fits your requirements which they are positive you can see with payback. When that remains in place, you are armed with the best info you need before choosing the finest vehicle for you.

Nonetheless, the large con for getting your funding with a financial institution is Continued that the rates of interest they supply are frequently greater than the nationwide standard. Big, national banks often tend to run 10-percent above ordinary and regional banks run 24-percent above standard, while credit score unions normally offer rates 19-percent below the nationwide standard.

Although a standard financial institution can be an outstanding option for financing your brand-new wheels, you might be in much better hands at a local credit score union. Banks remain in business of generating income for the shareholders on top, which can equate right into rate of interest that are not as affordable as those at a lending institution, where the member is likewise an owner.

Everything about Honda Of Bellingham

A credit report union is open to making adjustments and tweaks to the loan product to set you up for success. Credit report unions are additionally understood for their superior member service.

They function hard to enlighten their participants by providing fantastic sources to help you recognize your financial resources, as well as their product or services. Again, when you, the participant, are stronger, the cooperative credit union is stronger. If you are currently a lending institution participant, or you are drawn to the individual touch and extensive education they offer, you are certain to find a terrific loan program there for your car purchase.

Prior to you allow anyone try to offer you anything, do your homework (Honda of Bellingham). What make and version would certainly you actually such as? If you want to be adaptable amongst a few comparable options, that assists your chances of getting the most effective offer. As soon as you have a short-list, it is time to see what you can afford.

A Biased View of Honda Of Bellingham

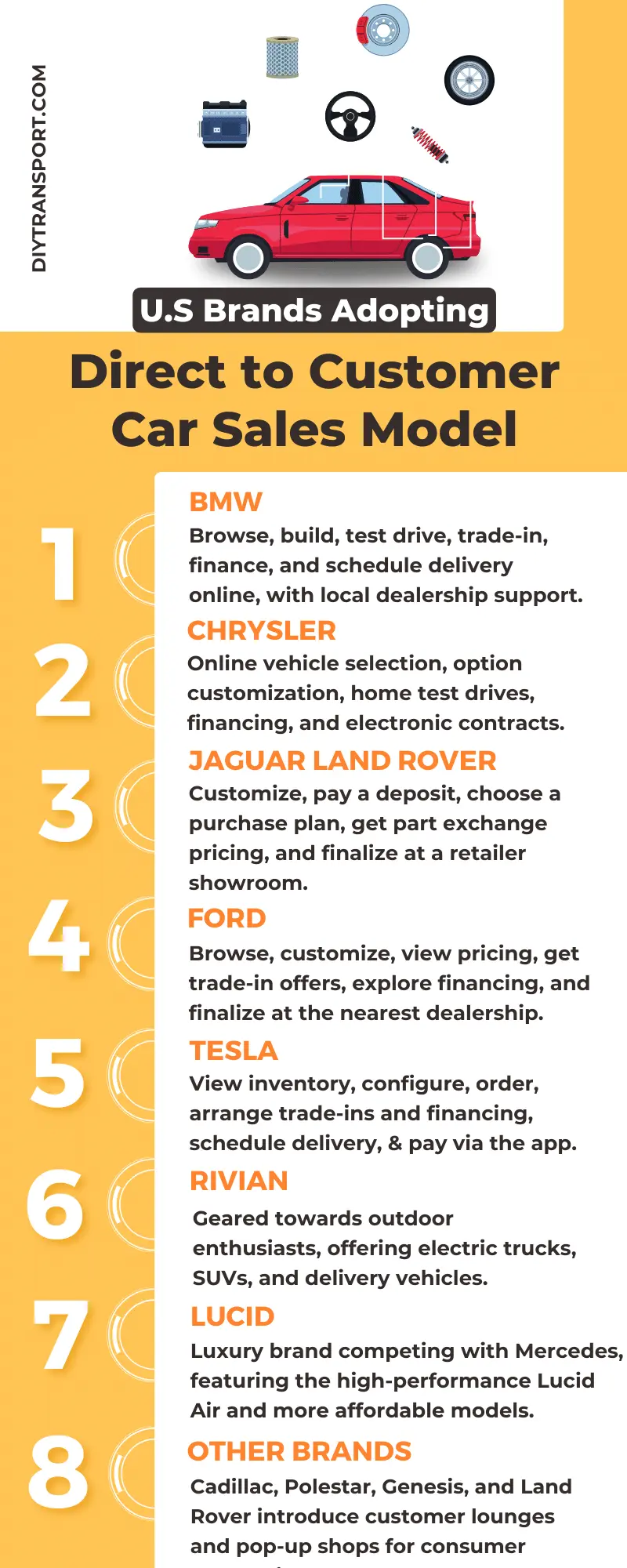

When it pertains to acquiring an auto, one of the first decisions you require to make is whether to purchase from a vehicle dealer or a private seller. Both choices have their own set of benefits and negative aspects, and recognizing them can considerably affect your car-buying experience. While auto dealerships use a wide choice of lorries and specialist services, private sellers typically supply an extra personalized method and potentially lower rates.